Resources

Data trends. Martech best practices. Hot takes. The strategies and solutions shaking up the market. Get all that and more in MessageGears’ resource library. We’re full of insights on customer engagement, data activation, and personalization.

Blogs

Data governance for healthcare marketers: Balancing personalization and patient privacy

Read more about Data governance for healthcare marketers: Balancing personalization and patient privacy

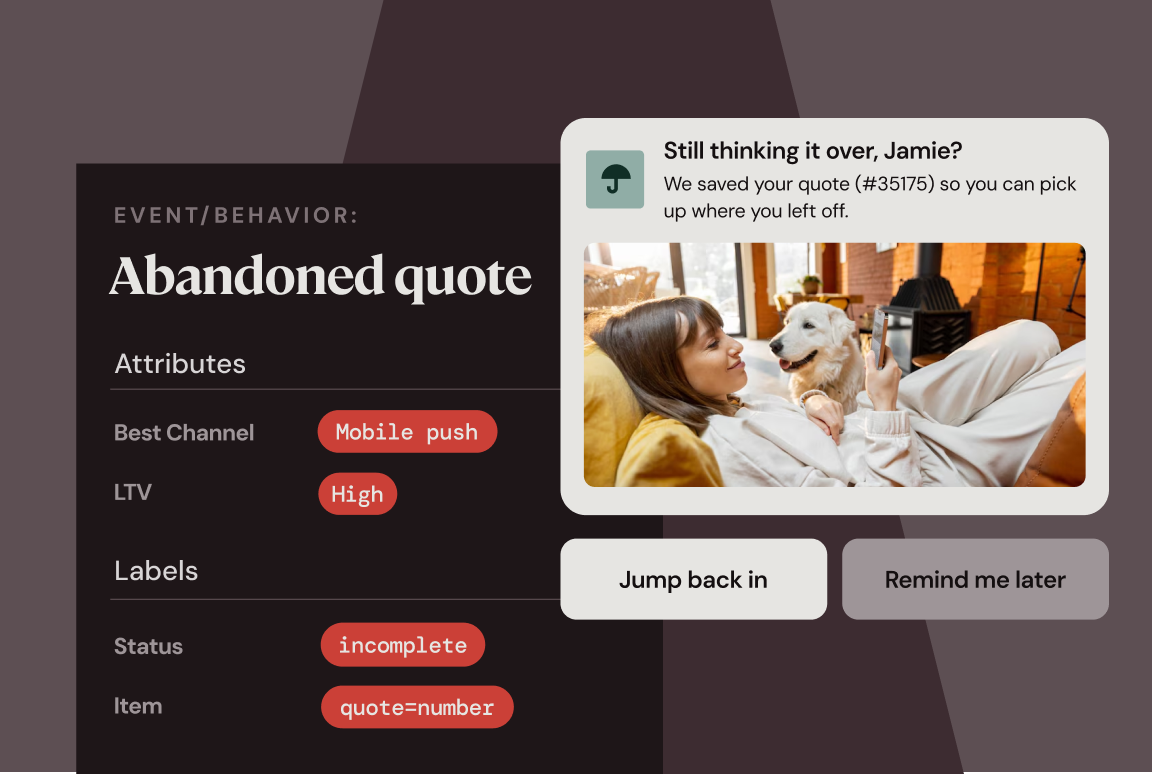

Engaging customers in the insurance industry without sounding like every other provider

Read more about Engaging customers in the insurance industry without sounding like every other provider

5 tips for vetting SaaS vendors to avoid falling for martech hype

Read more about 5 tips for vetting SaaS vendors to avoid falling for martech hype

Data protection in the insurance sector: Why your martech stack matters

Read more about Data protection in the insurance sector: Why your martech stack matters

Dynamic segmentation: Harnessing live user behavior for real-time impact

Read more about Dynamic segmentation: Harnessing live user behavior for real-time impact

ETL vs. reverse ETL: What’s the difference?

Read more about ETL vs. reverse ETL: What’s the difference?

Audience segmentation tools for smarter marketing

Read more about Audience segmentation tools for smarter marketing

4 benefits of warehouse-native segmentation for retail brands

Read more about 4 benefits of warehouse-native segmentation for retail brands

Case studies

Chick-fil-A uses MessageGears to ensure customer privacy

Read more about Chick-fil-A uses MessageGears to ensure customer privacy

How OpenTable reduced campaign production time by 80% with MessageGears

Read more about How OpenTable reduced campaign production time by 80% with MessageGears

MessageGears helps Musictoday send more personalized, dynamic content

Read more about MessageGears helps Musictoday send more personalized, dynamic content

MessageGears is a catalyst for growth at Active Engagement

Read more about MessageGears is a catalyst for growth at Active Engagement

Telefónica uses real-time targeting to drive mobile app activation, engagement, and retention

Read more about Telefónica uses real-time targeting to drive mobile app activation, engagement, and retention

Digicel triples mobile engagement and increases retention by over 50%

Read more about Digicel triples mobile engagement and increases retention by over 50%

Three UK increases revenue by 79% with real-time mobile messaging

Read more about Three UK increases revenue by 79% with real-time mobile messaging

MessageGears and Snowflake help OpenTable take full control of their data

Read more about MessageGears and Snowflake help OpenTable take full control of their data

Guides

Martech buyer’s guide

Read more about Martech buyer’s guide

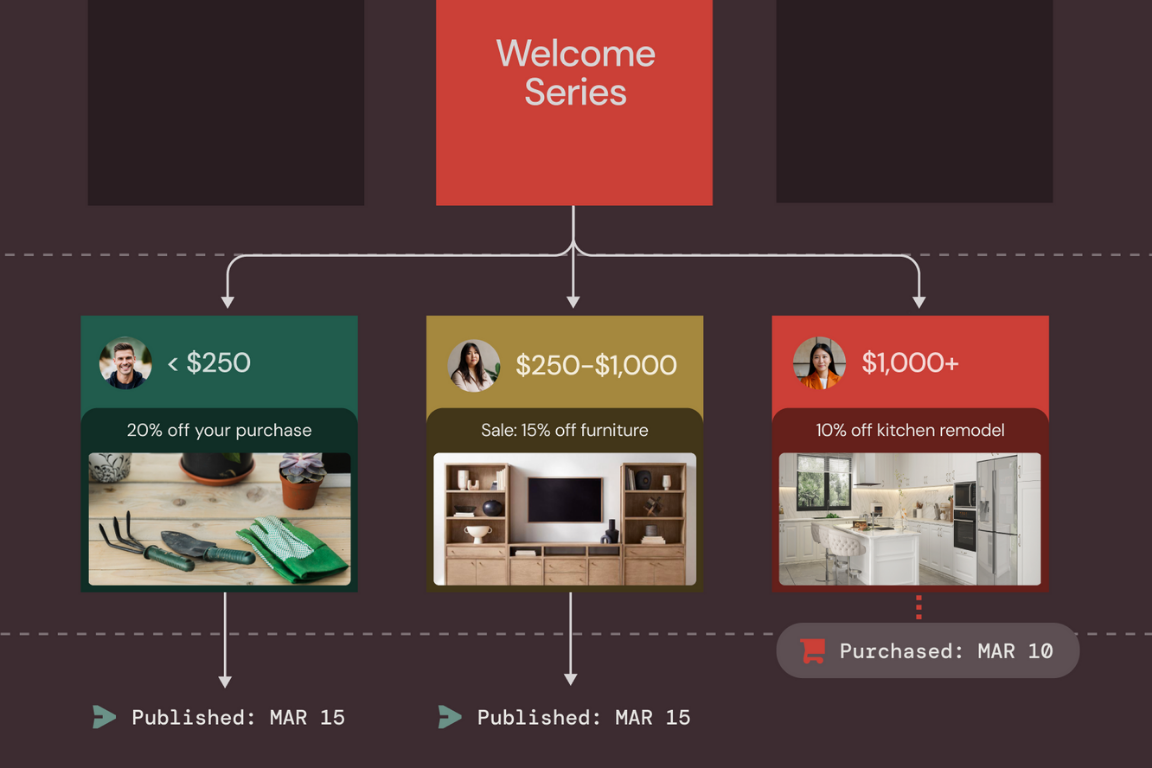

A retailer’s guide to better data activation in marketing channels

Read more about A retailer’s guide to better data activation in marketing channels

Your guide to better data activation

Read more about Your guide to better data activation

MessageGears consumer engagement report

Read more about MessageGears consumer engagement report

The guide to your Salesforce divorce

Read more about The guide to your Salesforce divorce

The enterprise guide to taking personalization beyond the status quo

Read more about The enterprise guide to taking personalization beyond the status quo

The enterprise perspective on AI and customer engagement

Read more about The enterprise perspective on AI and customer engagement

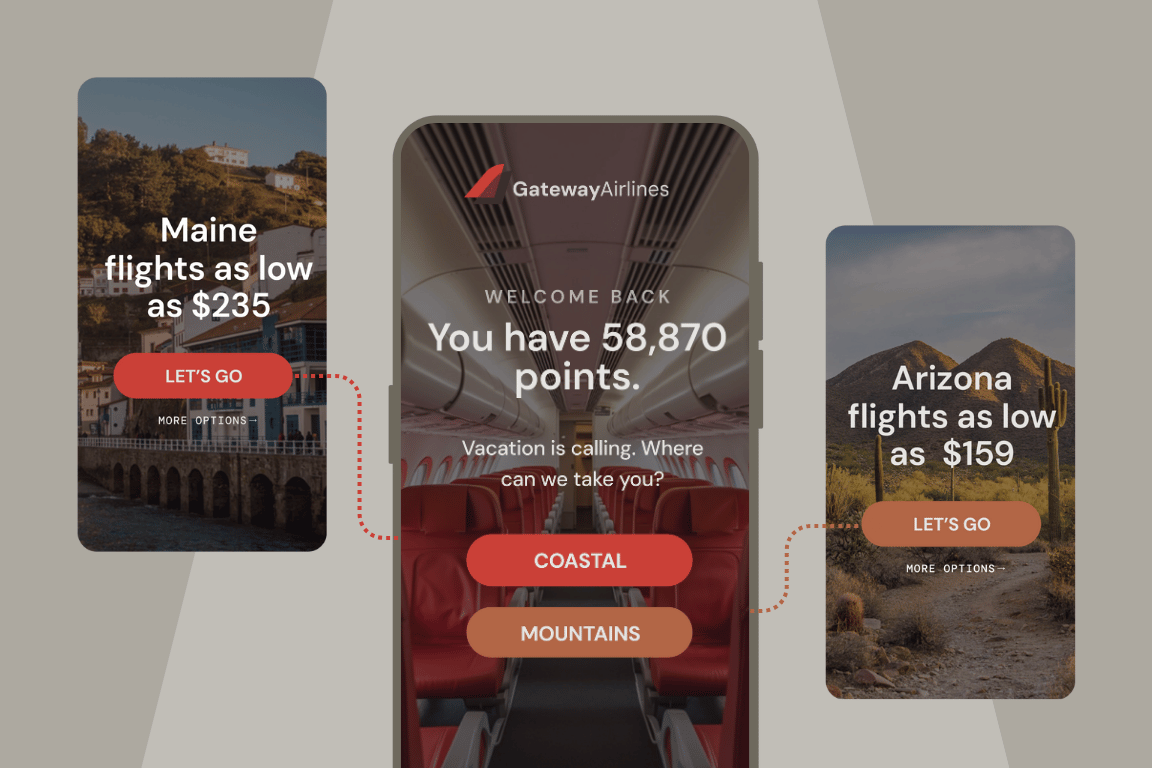

The enterprise guide to mobile customer engagement

Read more about The enterprise guide to mobile customer engagement

Events

Washington Nationals game

Learn more

Texas Rangers Game

Learn more

Seattle Mariners game

Learn more

eTail East

Learn more

New York Yankees game

Learn more

Arizona Diamondbacks game

Learn more

News

MessageGears partners with Databricks to power native data activation in enterprise marketing campaigns

Read more about MessageGears partners with Databricks to power native data activation in enterprise marketing campaigns

MessageGears announces enterprise campaign efficiencies for data-driven brands

Read more about MessageGears announces enterprise campaign efficiencies for data-driven brands

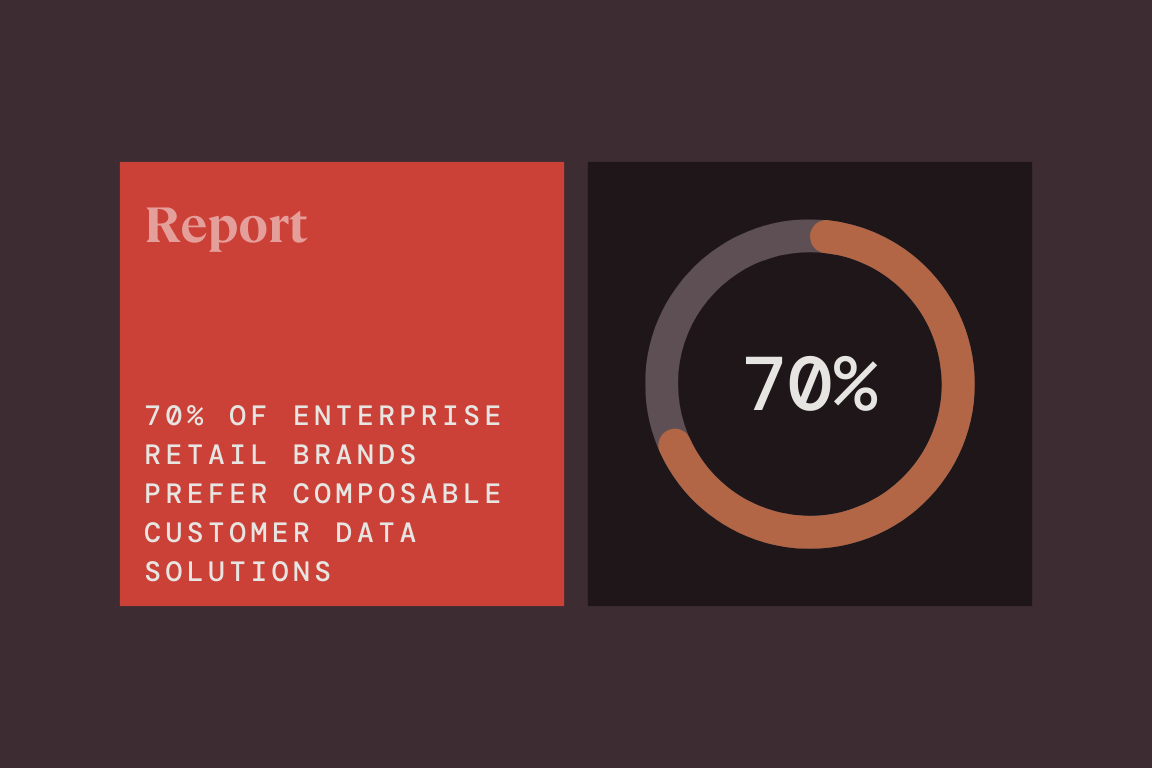

MessageGears report reveals 70% of enterprise retail brands prefer composable customer data solutions

Read more about MessageGears report reveals 70% of enterprise retail brands prefer composable customer data solutions

MessageGears predicts key consumer enterprise brand trends for 2025

Read more about MessageGears predicts key consumer enterprise brand trends for 2025

New MessageGears and Smartling integration powers email translation for Vimeo

Read more about New MessageGears and Smartling integration powers email translation for Vimeo

MessageGears report reveals packaged CDPs are losing steam with 56% of brands preferring composability

Read more about MessageGears report reveals packaged CDPs are losing steam with 56% of brands preferring composability

MessageGears recognized as “One to Watch” in Snowflake’s Modern Marketing Data Stack Report

Read more about MessageGears recognized as “One to Watch” in Snowflake’s Modern Marketing Data Stack Report

MessageGears launches the first composable end-to-end data activation and engagement platform

Read more about MessageGears launches the first composable end-to-end data activation and engagement platform

Webinars

Crawl, walk, run: How to implement a composable CDP

Read more about Crawl, walk, run: How to implement a composable CDP

Understanding composable CDPs

Read more about Understanding composable CDPs

How Chewy creates truly cross-channel campaigns with direct mail

Read more about How Chewy creates truly cross-channel campaigns with direct mail

Choosing the right martech to solve your data problems

Read more about Choosing the right martech to solve your data problems

How GoDaddy went from messy lists to campaign excellence

Read more about How GoDaddy went from messy lists to campaign excellence

Predictive AI trends for customer-obsessed brands

Read more about Predictive AI trends for customer-obsessed brands

7 email re-engagement tips to win back your audience

Read more about 7 email re-engagement tips to win back your audience

Ignite your marketing engine with the power of the data cloud

Read more about Ignite your marketing engine with the power of the data cloud