Blog

Engaging customers in the insurance industry without sounding like every other provider

Published on May 29, 2025

Insurance marketing has a relevance problem. Communications are heavily regulated, risk-averse by nature, and often so templated they read more like a legal boilerplate than customer messaging. Most providers only reach out at predictable moments – policy renewals, claim updates, payment reminders – and even then, the content feels generic and transactional.

That’s a problem. Because insurance is deeply personal. You’re dealing with people’s homes, health, finances, and futures. And while the stakes are high, the customer experience can feel low-effort and disconnected – more like checking a compliance box than building a relationship.

Why traditional insurance messaging falls flat

This isn’t a data problem. It’s a data activation problem. Most insurers sit on troves of rich behavioral, transactional, and contextual data. But legacy martech stacks, siloed data environments, and batch-driven workflows make that data nearly impossible to act on in a meaningful, timely way.

Marketing teams are stuck working with stale audience lists, manually exported and transformed from core systems into legacy marketing clouds that were never built for today’s data volumes or regulation-heavy use cases. By the time a campaign gets the green light, the data it’s based on is already days or even weeks old. Your customer might have moved houses, changed policies, filed a claim, or been impacted by a local event, and your messaging no longer makes sense.

Example: A customer adds a second car to their auto policy, but because your system only syncs data nightly, they receive a cross-sell email encouraging them to “add a vehicle” – two days after they’ve already done it. Or worse, they’re offered a quote for a cheaper tier of coverage than what they just purchased. That kind of delay is frustrating and, in a regulated space, can become a liability.

And while compliance concerns are very real, they’re often blamed for what’s ultimately a workflow issue. The underlying risk comes from customer data being outdated, misclassified, or exposed through poorly designed third-party systems. But the right infrastructure – one that activates data directly from your governed data warehouse – removes that risk. Nothing has to move, and nothing gets lost in translation.

The customer’s bar is higher than ever

Insurance customers aren’t just comparing you to other providers. They’re benchmarking every experience against brands like Amazon, Netflix, and Uber – brands that tailor every interaction based on real-time behavior and context.

They expect:

- Proactive guidance: Coverage alerts, renewal reminders, missing document nudges – before they become an issue

- Situational relevance: Context-aware messaging that reflects their location, what policies they hold, and what actions they’ve taken (or not taken)

- Cross-channel coherence: Seamless experiences across email, SMS, mobile, and call centers without duplication, contradiction, or confusion

Example: During wildfire season, California homeowners receive preparedness checklists, coverage reminders, evacuation tips, and real-time updates. Florida customers receive the same level of support during hurricane season – but tailored to their unique risk.

This is what modern engagement looks like. It’s expected. And it’s possible when your data is live, accessible, and connected.

How to stand out: 3 strategies for better engagement

To differentiate in a crowded, compliance-heavy market like insurance, you need to be able to activate your data in real time – without compromising governance or agility. Here’s how.

Real-time segmentation that reflects real-life behavior

Forget batch exports and static lists. Real-time segmentation happens directly on your live data – no copies, no syncing, no lag. Customer segments update automatically as behaviors shift, policies change, or locations vary – all in real time. You’re querying data in place, straight from your warehouse, with zero ETL and zero delay. That means more accurate targeting, faster execution, and no wasted time waiting on outdated snapshots.

Marketing teams can build dynamic segments like:

- Customers in high-risk areas during an active weather event

- New policyholders who’ve completed onboarding but haven’t downloaded your app

- Recently settled claimants eligible for satisfaction follow-up

- Policyholders showing lapse-risk behavior (missed payments, recent inactivity)

- High-value customers nearing renewal with declining engagement scores

Example: An auto customer involved in a collision files a claim online. They’re instantly removed from promotional journeys and placed into a claim support track with updates on repair timelines, rental car availability, and out-of-pocket costs – across email, SMS, and mobile app.

This type of situational messaging doesn’t require weeks of IT requests or complex automations. It just needs access to live data and flexible logic.

Always-on intelligence from your entire data ecosystem

Most traditional martech platforms force you to copy and upload data into their system before you can do anything with it – build segments, personalize content, execute campaigns. This approach introduces friction, delays, and unnecessary complexity.

Modern data activation doesn’t move data around. It activates it where it lives by connecting directly to your governed data warehouse. You query your live data in place and then use the results to drive real-time messaging and journey logic instantly, without maintaining fragile pipelines. It’s faster, cleaner, and built for enterprise scale.

This unlocks:

- Geo-targeted alerts: Send flood-prep guidance to homes with relevant coverage in forecasted zones – within minutes.

- Product-specific journeys: Trigger different onboarding tracks for renters, homeowners, auto, or life. (And properly cross-sell between them!)

- Policy lifecycle workflows: Remind users to update payment methods before expiry or flag coverage gaps during renewal periods.

- Behavioral nudges: Help first-time policyholders understand deductibles or document uploads based on app activity.

Example: Let’s say a cold front is forecast to hit Denver. Within seconds, you can identify policyholders with frozen pipe coverage in the affected area who haven’t filed a claim in the past 12 months – and send them a checklist via email to prevent water damage. If they don’t open the email within 24 hours, you can follow up with a push notification. No batching, no data lag, no redundant messaging.

All of this is driven by real-time events, live queries against your data warehouse, and direct execution across every channel – without ever exporting customer records to a third-party system. These timely, relevant interactions are what build trust and brand loyalty. And when renewal time rolls around, it’s what keeps you top of mind – not just as a vendor, but as a valued partner.

Unified cross-channel execution from one source of truth

Insurance marketing spans every messaging channel: email, SMS, push, in-app, web, and even direct mail. But when those channels are siloed, cross-channel experiences become disjointed with customers getting repeated reminders, mismatched offers, and conflicting advice.

With unified customer profiles powering your cross-channel campaigns, you can:

- Coordinate messages across channels in real time

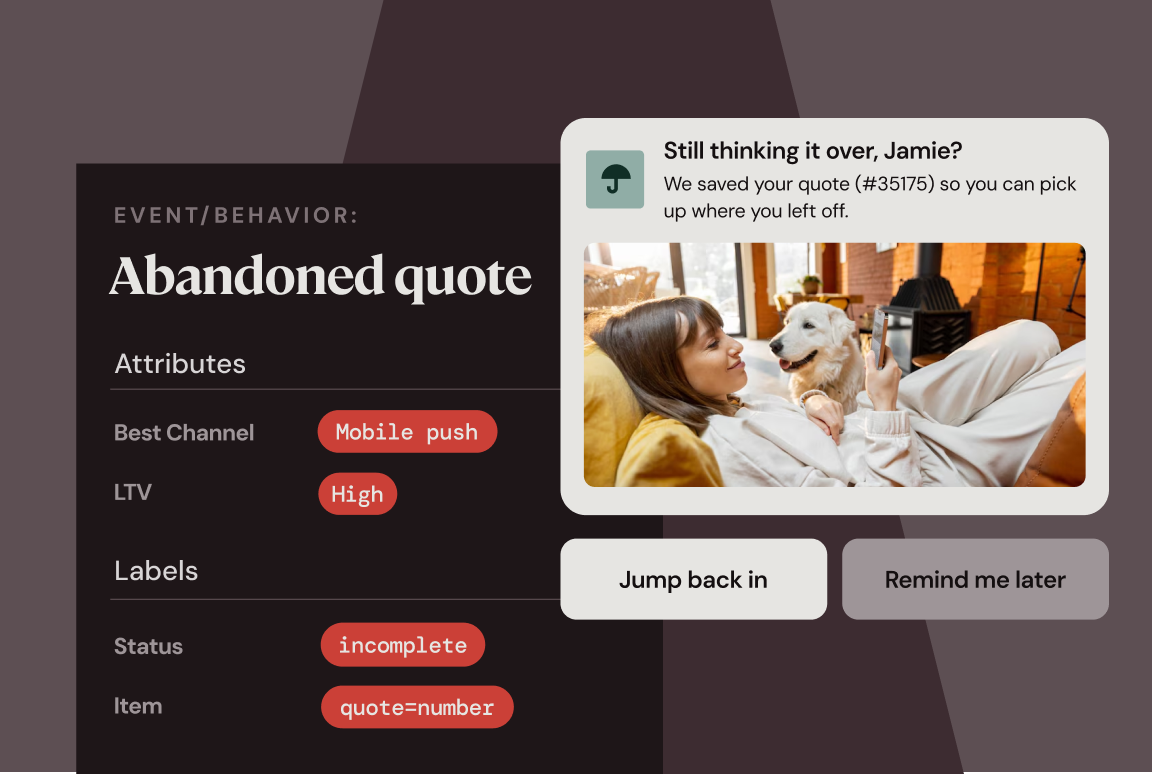

- Choose the best channel per customer based on urgency, preferences, and engagement patterns

- React to behavioral signals (or lack of them) to keep customers engaged

- Reduce fatigue by avoiding repeat messages or irrelevant offers

- Maintain consistent timing, message content, and offer logic across every touchpoint

Example: A customer gets an email asking them to upload documents to finalize a claim. No action taken? They receive a follow-up SMS with a direct upload link. Still nothing? You try a push notification. If there’s still no response, they get routed to a call center agent for human outreach, with full context included.

This kind of campaign execution isn’t possible with stitched-together point solutions. It requires a shared decisioning layer that pulls context directly from your trusted data source.

The MessageGears advantage for insurance brands

Most insurance orgs have the data they need to engage better. They just don’t have the tools or infrastructure to act on it fast, accurately, or securely.

That’s exactly what MessageGears is built for:

- Live data access, no copies or syncs: MessageGears connects directly to your data warehouse or lake (Snowflake, BigQuery, Redshift, Databricks, etc.) so marketers are working with real-time, production-grade data. No delays. No stale snapshots. You’re using the freshest customer context available, pulled straight from the source – every time you hit send.

- Event-driven architecture built for speed and scale: Trigger messaging instantly based on any live signal – from policy updates and claim submissions to behavioral data and geolocation pings. There’s no need to predefine every edge case. MessageGears listens to what’s happening across your ecosystem and responds the moment it happens.

- True cross-channel execution from a single source of truth: Whether it’s email, SMS, mobile, or web, MessageGears keeps every touchpoint aligned with your live data. You don’t need to duplicate logic or sync channels manually. Campaigns are powered by the same real-time dataset, so you avoid workflow fragmentation, conflicting rules, and versioning nightmares.

- Flexible, self-serve segmentation for every skill level: Marketing teams can build dynamic audiences without writing a line of code. Prefer SQL? Your technical users can go deeper, with full query control whenever needed. No more bottlenecks. No more back-and-forth with engineering. Just accurate targeting that evolves as fast as your data.

- Built-in governance: Security and compliance are enforced at the source. Because data never leaves your firewall, it’s never compromised, mishandled, or accessed by anyone it shouldn’t be accessed by. It’s all integrated directly into your marketing operations. No exposure. No vendor sprawl. No unnecessary risk.

- Enterprise-grade security and compliance by design: MessageGears works inside your existing infrastructure, so your customer data never leaves your environment. There’s no need to extract, move, or sync sensitive information to third-party platforms. Every campaign, audience, and trigger runs with built-in permissioning, auditability, and access control – dramatically reducing your risk exposure and simplifying compliance.

Whether you’re onboarding a new policyholder, sending urgent alerts, or nudging an at-risk customer, MessageGears gives you the flexibility and speed to communicate with your customers with what they need, when they need it – even in a highly regulated environment like insurance.

Build trust in every interaction

Insurance is built on trust. And every interaction is an opportunity to strengthen or weaken that trust. If your messaging feels delayed, out of sync, or like it’s missing the mark, it’s probably because you’re relying on outdated tools and fragmented workflows. But modern insurance customers expect more – and you already have the data to deliver it. You just need the right platform to turn that data into action.

With MessageGears behind you, it’s not only possible to engage better – it’s scalable, secure, and supports the entire policyholder journey. Don’t let your brand get lost in the noise. Show your customers you understand them, you’re there for them, and you’re different from the rest.

Want to stop sounding like every other provider?

MessageGears helps insurance providers deliver real-time, personalized customer experiences at infinite scale – without overhauling your tech stack, forcing you into workarounds, or compromising compliance. Keep your data where it is, maintain strict governance, and still move fast. Let’s talk about how we can help you stand out.